WONDERFUL! Why Is Crude Oil A Valuable Commodity

Petroleum also called crude oil is an important source of energy according to Natural Resources Canada. The price of oil has a huge impact on a wide range of other stocks currencies and bonds throughout the globe.

Oil Market Report For 2020 Will It Be As Bad As Expected Marketing Crude Oil Oils

Lifeblood of the industrialised nations Oil has become the worlds most important source of energy since the mid-1950s.

Why is crude oil a valuable commodity. Why is oil the most important commodity. Brent is the most popular crude benchmark with over 60 of crude contracts in the international markets. This is true in terms of both production and financial market activity.

There are a variety. Arguably no commodity is more important for the modern economy than oil. The world economy is dependent on these natural resources being traded on exchanges that specialise in commodity trading.

Why is Heating Oil Valuable. In spite of the recent interest in alternative sources of energy such as solar power crude oil remains a highly valuable trading commodity. Regulating the internet giants The worlds most valuable resource is no longer oil but data The data economy demands a new approach to antitrust rules.

This is why some traders. It is a crucial commodity for the global economy and geopolitics. In part this reflects the fact that there are actually more than 300 types of crude oil the characteristics of which can vary quite markedly.

Many economists view crude oil as the single most important commodity in. An extraordinarily ungrateful commodity -. An important oil benchmark Brent Crude refers to oil that comes from fields in the North Sea and includes Brent and Forties blends and Oseberg and Ekofisk.

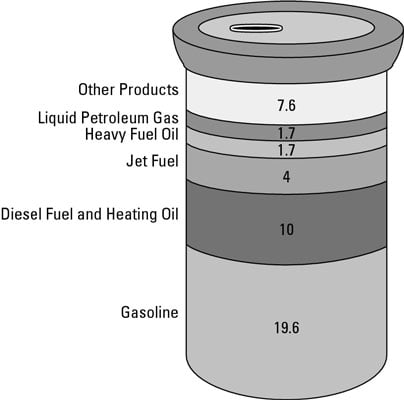

Low boiling point products. These industrial facilities separate crude oil which consists of different hydrocarbons into smaller component hydrocarbons known as. Yet its pricing is relatively complex.

The New York Mercantile Exchange futures price for crude oil is reported in almost every major US. That is why the global oil price is such a delicate balance of interests and why oil companies and governments like a stable price of somewhere between 40 and 60 a. Its crucial role as a source of heat in the winter months makes heating oil an important commodity in the global economy.

There exists a finite amount of crude oil one of the most valuable and demanded energy assets. They reflect the fortunes of industries like the oil business or farming. Heating oil production takes place in oil refineries.

Oil provided approximately 34 percent of the worlds energy needs in 2008. Crude oil is a global commodity that trades in markets around the world both as spot oil and via derivatives contracts. It is ideal for refining diesel gasoline and middle distillates.

A public institution that carefully separates the important issues from the trivial and then publishes a story about Paris Hilton instead. The increased supply is unlikely to have a significant impact on oil prices as this increase would happen gradually. Inside the distillation units liquids and vapours will separate depending on their boiling points.

Incidentally trading crude oil is a valuable resource that many investors and traders trade in the commodities market. Crude oil is the most-traded nonfinancial commodity in the world today and it supplies 40 percent of the worlds total energy needs more than any other single commodity. As a result oil supply is expected to increase by 1Mbpd in the market.

The uses of crude oil depend on how the raw commodity is refined and processed. What makes crude oil a valuable commodity for trading. Economic growth is an important factor that impacts crude oil demand and prices.

Prices are informed by supply and demand issues. Its products underpin modern society mainly supplying energy to power industry heat homes and provide fuel for vehicles and aeroplanes to carry goods and people all over the world. Commodity trading involves the buying and selling of raw materials on a number of exchanges and is normally traded as a futures contract.

These are then turned into different products. Commodity markets can be easier to understand than other financial markets because prices are influenced by more obvious contributing factors. The source of oil and gas are animals and plants that died millions of years ago the World Petroleum Council explains.

How Is Heating Oil Made. Currently crude oil remains the worlds primary source of energy even though there are. Crude oil is undoubtedly the king of commodities in both its production value and its importance to the global economy.

Importantly when refined you can get various products such as diesel Gasoline and other petrochemicals. All these products make our living comfortable. Brent is light and sweet oil that is easy to transport.

In this way the NYMEX forecasts what oil traders think the WTI spot price will be in the future. Oil traders should understand how supply and demand affects the price of oil. The crude oil market is highly volatile and carries a range of opportunities for smart investors.

When crude oil is distilled at a lower boiling point it creates gas products such as butane and gasoline which are. Natural resources can include physical assets such as cotton wheat oil and precious metals. China is the worlds largest consumer of.

Why is oil a. The oil is commonly WTI. Crude oil is ranked among the most liquid commodities in the world meaning high volumes and clear charts for oil trading.

Why Is Petroleum Important. Commodity trading is just as important today with commodities playing a crucial role in global economics. A NEW commodity spawns a.

Since 2006 the importance of crude. It is the value of 1000 barrels of oil at some agreed-upon time in the future. This article describes some of the key features of the oil market.

Crude oil enables the production of petrochemicals gasoline diesel medical supplies textile household products electronics and cosmetics.

Every Country S Highest Valued Export History Geography African History Africa

Peak Oil Resources Page Peak Oil Petroleum Engineering Oil And Gas

Types Of Crude Oil Available For Investment On The Commodities Market Dummies

Bottled Crude Oil Oil Clipart Black Four Barrels Png And Vector With Transparent Background For Free Download Crude Oil Oil And Gas Big Oil

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Correlation_of_Oil_and_Currency_Oct_2020-02-24430bb162bd4d678a7b5399ff4148e5.jpg)

Understanding The Correlation Of Oil And Currency

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Correlation_of_Oil_and_Currency_Oct_2020-01-428a077c77d84c4880978d4c52063b55.jpg)

Understanding The Correlation Of Oil And Currency

Mcx Commodity Affected Us Payroll Data Has Come 6 Pm And Non Manufacturing Pmi Data Which Will Come At 7 30 Pm Gold Futures Gold Price Gold Rate

Asia Grows As A Crude Oil Price Maker Financial Times Brandsuite By Cme Group

Share And Stock Market Tips Oil Rises On Firm Short Term Demand Outlook Gas Industry Crude Oil Futures Oil And Gas

Crude Oil In The United States Industry Profile Provides Top Line Qualitative And Quantitative Summary Information Incl Crude Oil Crude Oil Futures Oil And Gas

Oil May Drop Below 20 U S Pressures To End The Price War Oils War Crude Oil

Top 7 Factors That Affect Oil Prices Ig Uk Ig Au

Ripples Commodity Blog Oil Prices Edge Up On Expected U S Crude Inventor Stock Photos Crude Oil Futures Oil And Gas

Map Every Country S Highest Valued Export Ap Human Geography Map World Geography

Crude Oil Investing Gill Broking Crude Oil Crude Investing

Crude Oil Overview Importance How To Classify

Dollar Advisory Best Commodity Tips Provider Crude Oil Slid More Than 2 Percent Knocked Off 18 Month Highs As The U S Dol Crude Oil Crude Oil Futures Crude

:max_bytes(150000):strip_icc()/dotdash_Final_5_Steps_to_Making_a_Profit_in_Crude_Oil_Trading_Aug_2020-01-58f79ee3d9fd4ee384ef25284ad48aca.jpg)

Crude Oil Trading 5 Steps For Making A Profit