Clever! Why Do Churches Not Have To File A 990

A church an interchurch organization of local units of a church a convention or association of churches an integrated auxiliary of a church such as a mens or womens. Check the exemption letter that your organization received from the IRS to find out for sure Annual receipts less than 25000.

Pin On Case Statement Examples Campaign Brochures

Some religious institutions such as churches arent required to file Form 990.

Why do churches not have to file a 990. If the IRS would determine that the church is not a church by IRS guidelines then those tax-deductible receipts are not valid. Most churches in order to be certain that their tax-deductible receipts are valid prefer to have IRS church status protecting their congregants from possibly having their offerings being disallowed as tax-deductible. Section 6033 exempts several organizations from the Form 990 reporting requirements including the following.

The exceptions listed above are not available to a supporting organization unless it is an integrated auxiliary of a church No. This has not been true for approximately forty years. Form 990 Tax Filing Requirements for Churches.

There is a misunderstanding that organizations included in a church group ruling do not have to file a Form 990 Form 990-EZ or Form 990-N. Churches are presumed to be tax-exempt while secular organizations are presumed to not be exempt. Still they may have some potential reporting and taxation obligations such as unrelated business income taxes UBIT and employment taxes.

Churches some church-affiliated organizations and certain other types of organizations are excepted from filing. 2 above or an exclusively religious activity of a religious order No. It is because of their special protected status that churches have the potential to influence their community and beyond in ways the government cant.

Based on the presumption of tax-exemption as part of the larger principle of government non-interference in the free exercise of religion. Form 990 Filing Requirements Churches can also voluntarily file annual information returns 990-N 990-EZ or 990 to the IRS based on their Organization gross receipts. No taxes due to sphere of authority.

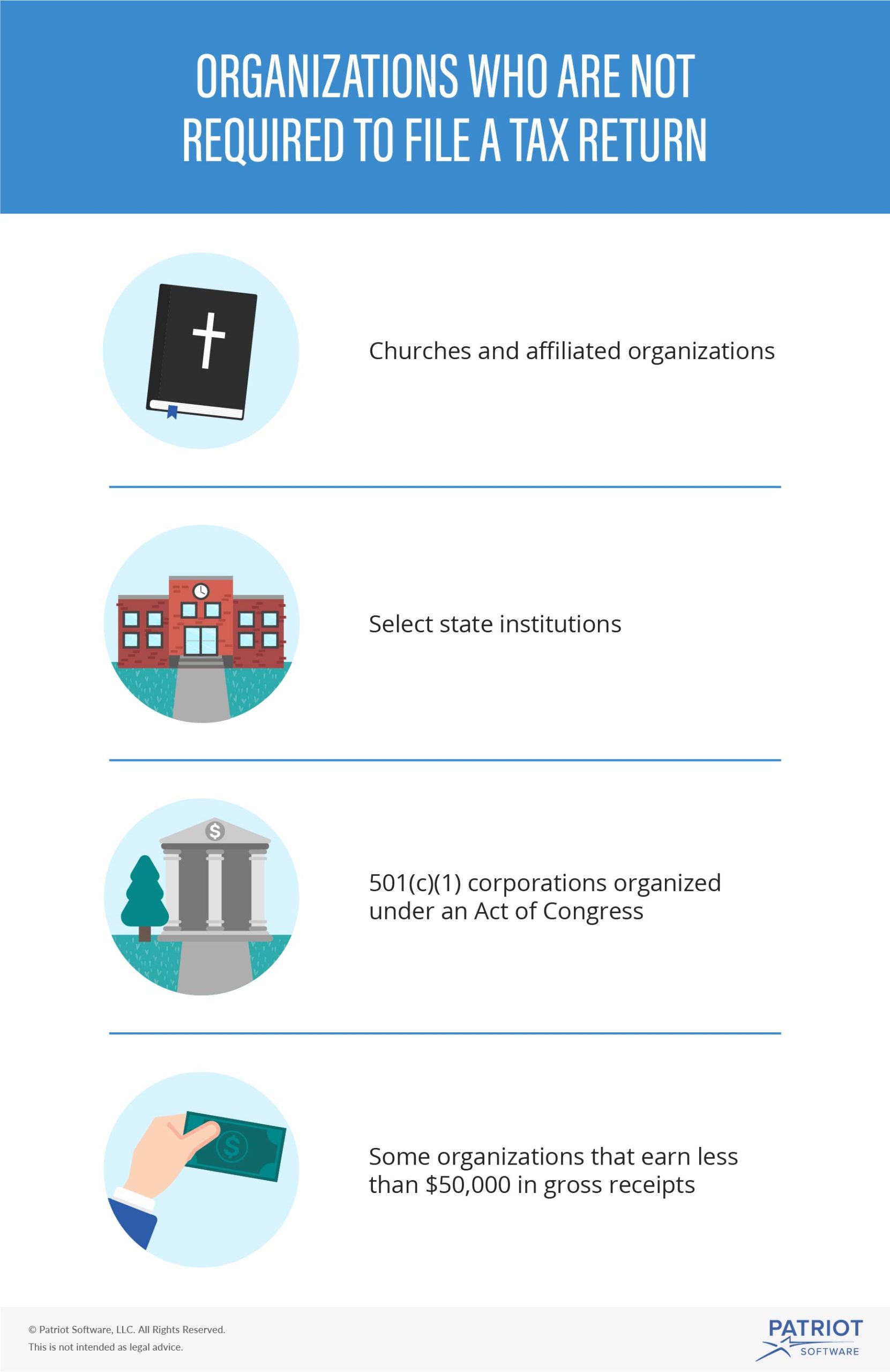

A Section 509 a 3 supporting organization must generally file Form 990 or 990-EZ. Although most tax-exempt nonprofits must file annual tax returns some organizations who are not required to file a tax return include churches and affiliated organizations select state institutions 501 c 1 corporations organized under an Act of Congress and some organizations that earn less than 50000 in gross receipts. What Is 501 c 3 Exemption Status.

Although most tax-exempt organizations must file an annual information return form 990 with the IRS churches are explicitly excluded from this requirement by IRC section 6033. Heres the real rub though - If a church received Unrelated Business Taxable Income UBTI - the church does not file a normal income tax return such as a 1065 or 1120 but instead must file a variant of the Form 990 specifically Form 990-T. Organizations not required to file Form 990 or 990-EZ because their revenues are below the threshold amounts must still file an annual electronic Form 990-N with the IRS to advise the IRS that the organization still exists.

Information return or electronic notice which form it should file ie Form 990 Form 990-EZ or Form 990-N. Furthermore a different version of form 990 is give to the churches. Most small tax-exempt organizations whose annual gross receipts are normally 50000 or less can satisfy their annual reporting requirement by electronically submitting Form 990-N if they choose not to file Form 990 or Form 990-EZ.

Univ faculty NOT INTUIT EMPLOYEE. To offer a comprehensive understanding we have listed the filing methods the Arizona state accepts details of the form to file how an organization can extend its filing deadline the penalty imposed and other links to important resources. In the past we have not filed 990s as we are a small congregation.

Organizations with annual gross receipts of less than 25000 arent generally required to file Form 990. Scruffy Curmudgeon--PFFM IAFF Locals 71830 retired firefightermedic. Churches involved in income-producing activities must file Form 990-T if they generate gross income from an unrelated business of 1000 or more for a taxable year.

It is vital for other organizations to properly and legally enroll themselves under IRS to prevent tax payments. According to the IRS a church or a body of believers is exempt from taxation by the federal government. Moreover churches do not have to register themselves under IRS for tax evasion.

Nonprofit S Need To Remember The Form 990 Is Also A Fundraising Tool Fundraising Charity Fundraising Non Profit

Everything Nonprofits Need To Know About Form 990 In 2021 Boardeffect

Nonprofit Organization Nonprofit Startup Start Up Non Profit

Church Exemption From Financial Transparency And The Abusive Power It Breeds By Allison Ivey Medium

5 Reasons We Should Never Tax Churches Even If John Oliver Is Right Commentary

Should Your Favorite Ministry Become A Church Christianity Today

Covid 19 Prompts Churches To Cancel Livestream Or Change Services Local News Buffalonews Com

When A Pastor S House Is A Church Home Why The Parsonage Allowance Is Desirable Under The Establishment Clause The Federalist Society

Atheist Group Asks To Disclose To Irs What Churches Disclose Nothing

What Is A 501 C 3 Church Benefits Vs Disadvantages Of 501c3 Status

Irs Form 990 Nonprofits With Income 25 000 Except Churches Mu

Sorry 666 Churches Fear 990 More Christianity Today

What Is The Difference Between A Church And A Religious Organization Perlman And Perlman

Family Tree Personalized Pkg Of 3 Etsy Family Tree Art Family Tree Designs Family Tree Gift

Churches And Other Faith Based Organizations Can Receive Emergency Funds In Unprecedented Move By The Sba

Not All Business Has To Be For Profit Start A Non Profit Nonprofit Startup Nonprofit Organization Business

Do Nonprofits File Tax Returns If They Re Tax Exempt