BANG! Why Are Cook County Taxes So High

At more than double the national average of. This is because in part the State of Illinois is only funding approximately 27 of public education.

States With Highest And Lowest Sales Tax Rates

Tax Development Aug 10 2021.

Why are cook county taxes so high. The average household in Lake County last year paid 268 of the value of their single-family home in property taxes according to ATTOM Data Solutions. The exact property tax levied depends on the county in Illinois the property is located in. Cook County Property Taxes Are Too Damn High.

Taxpayers wont know the full effect of this pandemic. Cook County second installment property tax bills for tax year 2020 will be mailed during the last week of July. Tax bills give the answer First Installment due March 1.

If the government decides that they need more money to run the government taxes for. The Cook County clerk reported that the average property tax rate for a single-family dwelling or commercial property in 2018 was. And its not just to other states.

Incompetent Illinois politicians still cannot balance the budget. High property taxes insulate. Cook County Taxes - Wondering why your taxes are so high.

Cook County Assessor Fritz Kaegis attempts to fix a property tax assessment system widely viewed as unfair continue to shift the tax burden away from homeowners and toward businesses. The higher your property is valued the larger your tax burden. Curbing new spending and seeking additional revenue sources not tied to real estate is the only realistic solution to the question of why real estate taxes seem so high in Cook County.

The Cook County Treasurers Office has announced that second installment 2020 tax bills will be mailed mid-August and will be due October 1 two months later than the usual August 1 payment deadline. What they found was outrageous and shocking. Some Cook County business owners have been left wondering if there were typos on their 2020 property tax bills as their taxes soared 300 400 or even 1000 percent this year.

Effingham County had the states lowest average property tax amount at just 861 and a 066 tax rate while Cook County 280 rate averaged 6264 and Will 230 rate averaged 5660. Lake County had the Chicago areas highest average tax bill for a single-family home. Cook County Property Taxes Soaring due to budget deficits throughout the state.

This massive issue has spread to laying unfair taxes on poor and middle management people that resulted in them paying high taxes. The Better Government Association paired with CBS Channel 2 did a recent investigation on the Treasurers Office of Maria Pappas. The average price of a single-family home was 227753.

Why are your Cook County property taxes so high. Property taxes are so important says Blomquist that they are one of the key indicators of likely profitability for real estate investors who buy Attoms reports. But the county assessor explained that they are looking for bright new ways to make.

The Illinois Republican Party issued a. He has spent weeks complaining about high property taxes and calling for a freeze. This amount is considerably short of the 50 it is supposed to be funding.

Lake County collects the highest property tax in Illinois levying an average of 628500 219 of median home value yearly in property taxes while Hardin County has the lowest property tax in the state collecting an average tax of 44700 071 of. Counties had a higher average. So if your property is assessed at 300000 and your local government sets your tax rate at 25 your annual tax bill will be 7500.

Homeowners in Illinois paid an average of 5048 in property tax in 2018 according to the Irvine California-based data company. Springfield lawmakers have yet to learn the lesson that money walks. The Illinois Property Tax Appeal Board has decided former President Donald Trump is due a 1 million refund on his skyscrapers 2011 tax bill ruling last month that the Cook County Board of Review overestimated the value of the buildings hotel rooms and retail space.

Mismanagement fraud and disrespect for the taxpayers money were found through out the system under her daily. Sometimes it walks past the legal. They were all in the New York or San FranciscoSan Jose.

Why property taxes are so astronomical Page 2 ILLINOIS REMAINS IN THE LEAD Property taxes in Illinois are very high in comparison to most other states. So far the tax issue has become a big issue in the governors race. Cook County needs 161 billion in property taxes to run the municipalities which is a 534 million increase.

The root cause of so many errors that happened with senior citizen exemption was due to high paperwork and an outdated system. The tax bill delay was a result of a conflict between the Assessors Office and the Clerks. In Cook County residential property is taxed at 10 commercial at 25.

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Americans Are Migrating To Low Tax States Native American Map United States Map States

Low Tax States Are Often High Tax For The Poor Itep

High Taxes Mean Less Revenue For Some States Personal Liberty Map Illinois Small Business Organization

Illinois Has The Highest Taxes Nationwide Report Finds Mystateline Com

All American Floats Illinois River Tubing Tahlequah Ok Illinois River Illinois River Oklahoma Tubing River

Ridgeview High School In Colfax Illinois Is In A School District That Received More Than 850 000 In Tax Money During The First Three Wind Farm Illinois Wind

Do You Live In The Most Self Loathing State In The Nation Fun Facts Dark Humor Funny Texts

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Property Tax Low Taxes Tax

I M Fine Illinois Financial Information Salary Calculator

Property Taxes By State Embrace Higher Property Taxes

States With The Highest And Lowest Property Taxes Property Tax States High Low

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

If You Are Buyer And Want To Consult With An Experienced Broker You Could Really Benefit From Our Hourly Consulting Four Ho Brokers Business Chicago Illinois

The Dual Tax Burden Of S Corporations Tax Foundation

Pin By University Of Illinois Extensi On Finances Work Scholarships For College Credit Education Financial Aid For College

The States Where People Are Burdened With The Highest Taxes Zippia

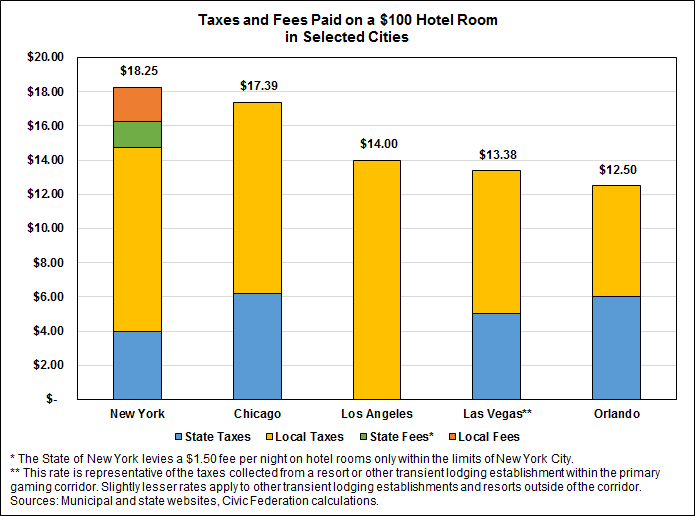

How Do Chicago S Hotel And Home Share Taxes Compare To Other Cities The Civic Federation

Businesses Black And Latino Homeowners Hit Hardest After Cook County Property Tax Hike Wgn Tv