BANG! Why Was My Md State Refund Adjusted

You can check the status of your Form 1040-X Amended US. To qualify the larger refund or smaller tax liability must not be due to differences in data supplied by you your choice not to claim a deduction or credit positions taken on your return that are contrary to law or changes in federal or state tax laws after January 1 2019.

Maryland State Tax Refund Status Md Tax Brackets Taxact

Individual Income Tax Return using the Wheres My Amended Return.

Why was my md state refund adjusted. I sent in my amended return May 182017After waiting 16 long weekson the wheres my amended return toolIt stated to take action and gave me a to callthe lady said my return was adjusted today Sept 8th and still have to wait additional 3-4 weeks before I receive a refundI did this before and it took 10-12 weeks to receive my. Any organization institution or association that is incorporated as a private non-profit organization designated under 501c3 of the Internal Revenue Code and has been operating for at least 2 years as of the application deadline that provides services or activities in Prince Georges County and that can supply sufficient documentation that their organization is. Online tool or by calling the toll-free telephone number 866-464-2050 three weeks after you file your amended return.

Both tools are available in English and Spanish and track the status of amended returns for the current year and up to.

How Do I Check When I Will Receive My Amended State Return

Comptroller Of Maryland Comptroller Franchot Using Statutory Authority Granted To Him Is Extending The State Income Tax Filing Deadline By Three Months Until July 15 2021 And All New Tax Forms

Irs Tax Audits What Should I Expect Call Maryland Tax Attorney Charles Dillon

Maryland Comptroller General Assembly Declare Open Season On Tax Fraud Maryland Association Of Cpas Macpa

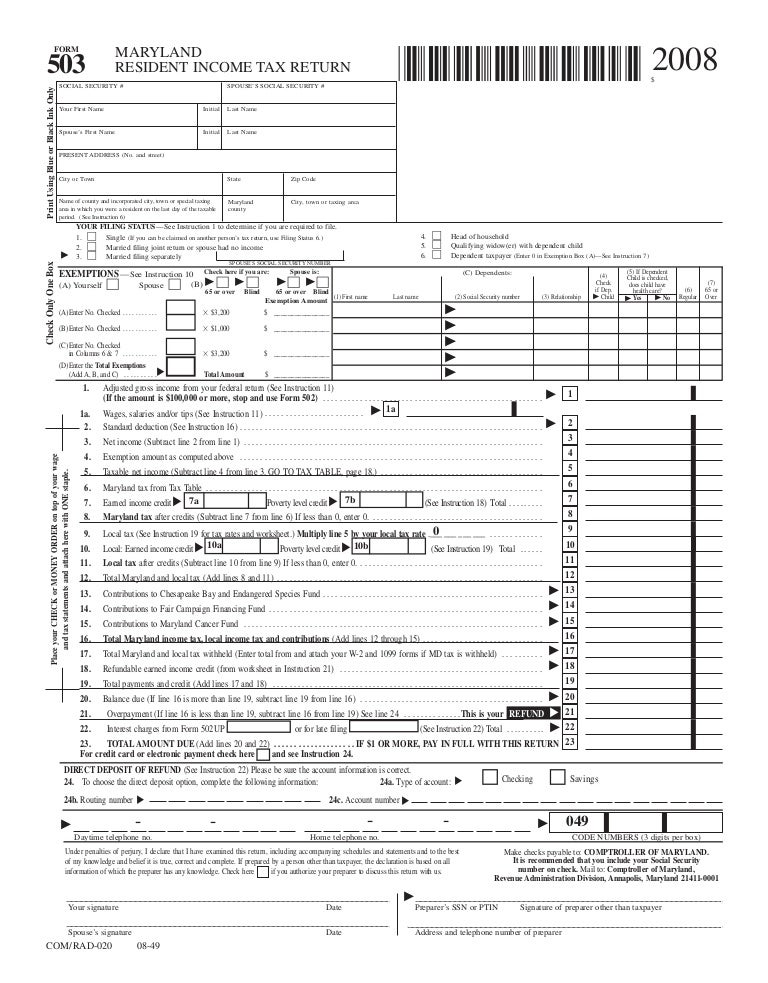

2013 Form Md 502 Fill Online Printable Fillable Blank Pdffiller

When Should You Amend Your Tax Return The Turbotax Blog

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Revised Maryland Individual Tax Forms Are Ready

What Can Maryland Do If I Owe Taxes

3 11 3 Individual Income Tax Returns Internal Revenue Service

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Irs Letter 4364c Amended Return Notification H R Block

It S Not Tax Day Here S What You Need To Know About Filing Taxes This Year Cbs Baltimore

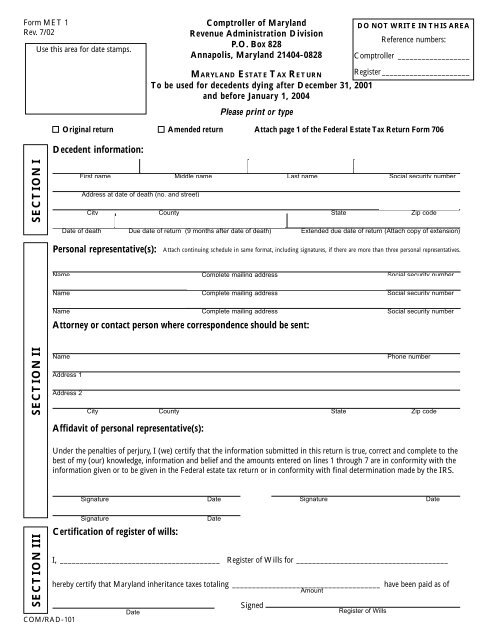

Maryland Maryland Estate Tax Return The Comptroller Of Maryland

Fill Free Fillable Forms Comptroller Of Maryland

If You Are A Maryland Resident You Can File Long Form 502 Or You May